The smart Trick of Retirement Income Planning That Nobody is Talking About

Table of ContentsHow Retirement Income Planning can Save You Time, Stress, and Money.5 Easy Facts About Retirement Income Planning DescribedGet This Report about Retirement Income PlanningSome Ideas on Retirement Income Planning You Should KnowThe Single Strategy To Use For Retirement Income Planning

Stakeholders have observed that workers would profit by simplifying the process for transferring funds in between retirement lorries when they change tasks. Occasionally, funds that had actually been set aside for retirement are withdrawn as well as made use of prior to retired life. An estimate of these funds withdrawn might be as high as 2.This issue short offers a summary of several types of solutions and devices that can be helpful. There are a number of factors why the above improvement in solutions and also devices in our retired life system may be appealing to employees, and why plan adjustments to urge those remedies must be thought about. retirement income planning. Suitable aspects of a national retirement plan are highlighted in italics listed below.

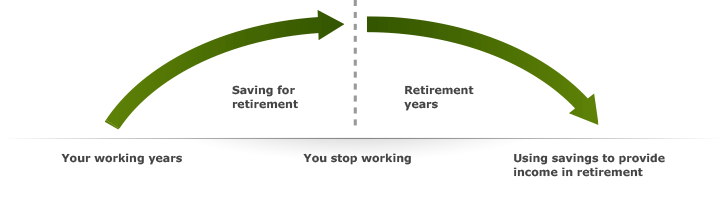

Greater effectiveness in the accumulation phase can result in larger accumulations, and also higher efficiency in transforming buildups to life time earnings can lead to greater as well as extra stable earnings. One essential objective would certainly be to help with employees' capacity to track as well as take care of retirement savings they have actually built up from multiple resources, such as competent retirement (e.

Combination would additionally supply a chance for higher performance in areas such as recordkeeping as well as financial investment administration. A second goal must be to supply aid to senior citizens in converting retired life savings into stable retirement income. There are a range of approaches to convert retired life savings right into retirement income, each with benefits and drawbacks.

4 Simple Techniques For Retirement Income Planning

A disagreement can be made that the solutions and also tools can be implemented currently without any further regulations or law. This may hold true. The services and also tools can usually be made complex and beyond the reach of many employees as well as retirees and also those employees as well as retirees are the ones that are most vulnerable to being unable to secure a sensible retirement.

In addition, lots of workers are self-employed or job for employers without retirement strategies. The employer strategy is not the answer for everyone, also with government requireds.

It may be prudent to explore whether they can help promote several of these solutions without hindering what jobs well in the economic sector. The renovations recommended in this issue short can help close the space in between retired life revenue requirements and also sources. There have been recent efforts in a number of relevant locations (see the Appendix for more detail), yet a lot more can be done.

B. 2016 ERISA Advisory Council Report: The difficulties to reliable transportability are highlighted in this report. C. retirement income planning. Thrift Financial Savings Plan: Millions of Americans who benefit the federal government have accessibility to a retirement strategy that incorporates much of the attributes described above relative to investments as well as decumulation alternatives.

Retirement Income Planning for Dummies

DOL Safe Harbor IRAs: In 2004, the department published a secure harbor law, at 29 C.F.R. 2550. 404a-2, permitting necessary individual retirement account rollover circulations of quantities of $5,000 or less for terminated individuals. These auto-IRAs must be invested in an item that meets the needs for conservation of principal as well as provide an affordable rate of return, the fees as well as expenses have to not go beyond those billed by the supplier for a comparable, non-automatic rollover individual retirement account, and the participant needs to have the right to enforce the legal terms of the IRA.

If you are Medicare-eligible, contrast the state-sponsored why not try here additional health care plan (Medigap) to other Medigap plans offered. Investigate Long Term Treatment, if you don't already have a strategy.

Consider financing long term treatment insurance coverage, if you have not done so already. There is a half opportunity that today's 65 year-old couples could live well past the age of 90. Climbing wellness treatment costs, coupled with poor health and wellness care insurance coverage, can have a destructive influence on your retirement earnings strategy.

Some Known Details About Retirement Income Planning

Purchase your monetary future by making the most of the University's retired life and delayed settlement strategies. Professionals approximate that you will certainly need at the very least 70% of your annual revenue for each and every year of retired life. To construct an adequate savings, it is very web link important to conserve as long as you can regularly with time. retirement income planning.

The University does not contribute to your SRP account. Circulations from previous companies' retired life plans can be rolled over to the SRP. For even more information, please get in touch with TIAA. The Educator Insurance and Annuity Association (TIAA) is the sole company browse around these guys of recordkeeping services for the Retirement accounts. To assist you with your concerns concerning saving for retired life, TIAA gives totally free economic therapy.

Usage i, Retire as a fast and repeatable means to kick start the conversation around retired life revenue. Rapidly highlight how you'll help clients and leads navigate tradeoffs in exactly how they conserve, invest and invest to as well as through retirement. Watch this short video clip to find out extra.

Some Of Retirement Income Planning

(Complete old age ranges from 66 to 67, depending upon the year in which you were born.) Learn your full retired life age, and also work with your monetary expert to explore exactly how the timing of your Social Safety and security benefit matches your total plan. One of the most useful advantages UC offers is UC's pension planthe UC Retirement Strategy, or UCRP.